Australian Financial Services Licence (AFSL) Compliance

- Home/

- Digital Solutions/

- Australian Financial Services Licence (AFSL) Compliance

Digital Solution

AFSL Compliance Portal

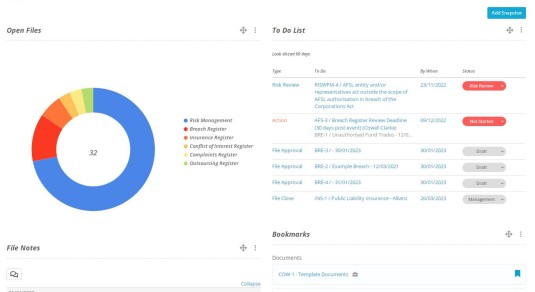

Compliance Calendar with portal reminders to ensure you never miss a compliance obligation or deadline.

Regulatory Registers are stored and entered through the portal, ensuring you capture the correct information every time.

Risk Management Framework including a risk matrix to provide a comprehensive risk analysis of your licensed business.

Document Management for critical dates, obligations and version control, including document storage, keeping all your license related collateral in the same place.

Reporting functionality that allows you to export any combination of data within the portal via spreadsheet or interactive pdf.

Legal services can be paired with our digital solution and are designed to cover key compliance obligations:

Policies, procedures and templates that are maintained for current compliance throughout your subscription period.

Compliance committee meetings chaired and minuted by our financial services lawyers.

News feed of relevant financial services updates and regulatory changes.

Legal Helpdesk to obtain legal advice in relation to your AFSL authorisations and compliance issues.

Guides, FAQs, checklists and manuals which provide guidance on giving advice and all of the above.

Portal subscriptions are tailored to suit small businesses to large national firms, from accounting firms with a limited AFSL authorisations, through to firms with full AFSL authorisations servicing retail or wholesale clients, managed investment schemes, and non-cash payment providers.

AFSL Portal Subscriptions – Get in touch

Legal Expertise

Cowell Clarke‘s financial services team has extensive expertise in financial services law. We provide a full range of legal and regulatory services to Australian financial services licence (AFSL) holders and authorised representatives to assist them in ensuring that they are meeting their ongoing compliance obligations.

Financial Services expertise – Learn more